Asset Management Update - Summary of the European Commission's proposal to amend the AIFM Directive and the UCITS Directive

The European Commission's proposal[1] to amend the AIFM Directive[2] and the UCITS Directive[3] (after this the "Amending Directive" and the "Proposal") must be seen in the light of the European Commission's Capital Markets Union Action Plan, which consists of a 5-year timetable within the adoption of a number of concrete legislative proposals to establish a single market for capital in the EU – a so-called Capital Markets Union.

[1] COM(2021)721.

[2] Directive 2011/61/EU on Alternative Investment Fund Managers.

[3] Directive 2009/65/EC on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities.

At the time of writing, the Proposal is being reviewed by the Council of the European Union to possibly propose amendments, after which the Proposal will undergo the same reading by the European Parliament. It is too early to predict which changes will end up being adopted in the final version of the Amending Directive, which is expected to be published only after a trilogue.

While the Proposal is being considered, NJORD's Banking and Finance Team has chosen to summarise the final Proposal for the Amending Directive, as proposed by the Commission.

REVISION OF THE AIFM DIRECTIVE – BACKGROUND

In particular, the proposed amendments to the AIFM Directive and the UCITS Directive are a result of the European Commission's long-standing revision of the application and scope of the AIFM Directive[1]. The European Commission's final report on the AIFM Directive was presented on 10 June 2020.

In the report, the European Commission concludes that the AIFM Directive has been well-functioning and has largely ensured the achievement of its purpose, i.e., the increase of investor protection, the improvement of opportunities for carrying out cross-border activities, or the reduction of systemic risk. However, the European Commission also states that the AIFM Directive could usefully be given improvements regarding specific elements of the regulatory framework, which had not been sufficiently considered when the directive entered into force back in 2013. Thus, on 25 November 2021, the European Commission was able to publish its final Proposal to amend the AIFM Directive and the UCITS Directive. In particular, the Proposal proposed entails changes as regards:

- Delegation agreements

- Liquidity risk management tools

- Reporting for regulatory purposes

- Provision of depositary and custody services

[1] Under Article 69 of the AIFM Directive, the European Commission had to start a review of the application and scope of the AIFM Directive by 22 July 2017.

OVERVIEW OF THE CHANGES

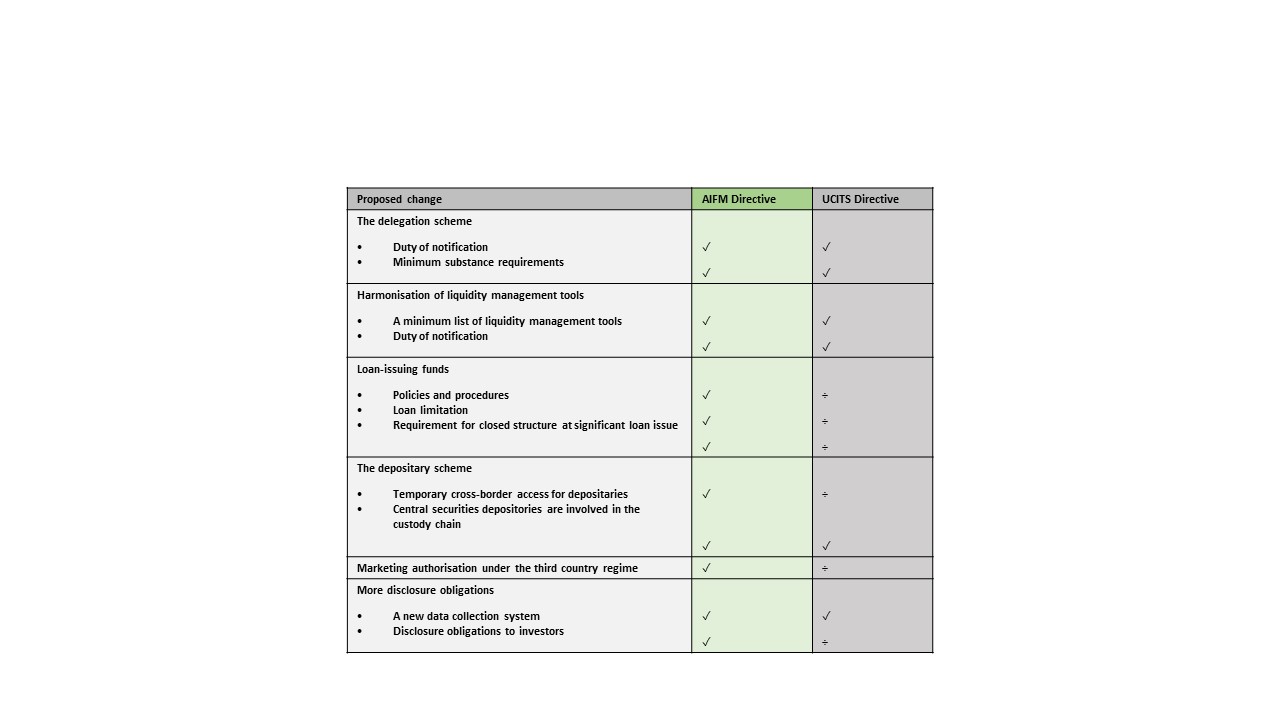

During the revision of the AIFM Directive, the European Commission found that a number of issues were just as relevant for UCITS as for alternative investment fund managers (AIFMs). Thus, the proposed Amending Directive mainly entails amendments to the AIFM Directive but also to the UCITS Directive in several areas. We have compiled an overview of the most significant proposed changes to the AIFM Directive and the UCITS Directive below.

NOT COVERED BY THE PROPOSAL

Several expected changes were unfortunately not included in the Proposal, such as:

- The possibility of widening the scope of the passport regime for "semi-professional investors", which currently is exclusive for to investors

- Clarification of the concept of reverse solicitation to introduce greater harmonisation and limitations on its scope

- A permanent and universal depositary passport to enable the provision of depositary services to be offered.

THE DELEGATION SCHEME

The delegation scheme under the current rules for AIFM and UCITS implies that essential tasks can be delegated to third parties, including portfolio management and risk management. In practice, this access is important in cases where third parties have specific expertise in a particular geographic market or asset class.

In particular, the European Commission's Amending Directive contains two adjustments to the delegation schemes:

1. Notification obligation

First, the Amending Directive requires national competent authorities in the EU to notify ESMA when a fund manager[1] in the EU delegates more portfolio or risk management functions to a third party outside the EU than the fund manager itself performs. In this context, ESMA shall be empowered to develop level 2 standards for communication. It should be noted that there is no requirement for the EU fund manager to retain a minimum of its activities in the EU.

The European Commission says the amendment aims to do away with differences in national supervisory practices that reduce legal certainty, increase disparities in supervisory outcomes and ultimately do not ensure consistent investor protection across the EU. The notification obligation from national competent authorities to ESMA can be expected to lead on an equal footing to increased reporting obligations for fund members to national competent authorities.

2. Minimum substance requirements for applying for authorisation

Secondly, the European Commission proposes that, when applying for authorisation as an AIFM or IFM, fund managers must meet certain minimum substance requirements, which means that the fund manager must have a minimum substance as opposed to being a de facto empty company. The Proposal further implies that the fund manager must, when applying for a permit, enclose, inter alia:

- A detailed description of the role, title, and level of seniority of each person, as well as a description of the reporting lines and responsibilities of those persons within and outside the management unit

- A detailed description of the human and technical resources that they will use to carry out their functions and supervise the delegate.

Also, it is proposed that the fund manager should hire or commit to employing at least two natural persons residing in the EU employed on a full-time basis.

The above amendments aim to further ensure that fund managers use the necessary human resources to carry out the tasks they carry out themselves. It also seeks to harmonise the regulatory framework for AIFM and UCITS in this area.

[1] A fund manager means an AIFM or an investment management company.

HARMONISATION OF RULES FOR THE USE OF LIQUIDITY MANAGEMENT TOOLS

Liquidity management is a key part of the Amending Directive. In addition to the proposed changes to the rules for lending funds (see below), the European Commission will introduce a harmonised minimum set of liquidity management tools in the AIFM Directive and the UCITS Directive. Read more below.

1. Minimum list of liquidity management tools

First, the European Commission's Proposal entails developing a minimum set of EU-harmonised liquidity management tools. More specifically, this means that the national competent authorities, including the Danish Financial Supervisory Authority, will have the power to ensure that the liquidity management tools specified in a future annexe must at least be available to the funds[1]. In this context, ESMA shall be empowered to develop level 2 standards for the detailed definitions and characteristics of the liquidity management tools.

At the same time, the Proposal introduces a requirement for managers of open-ended AIFs and IFMs to select at least one appropriate liquidity management tool from the defined list and adopt its application in the provisions of the fund manager or fund, including, for example, instruments of incorporation. In this context, detailed policies and procedures for the activation and deactivation of the selected liquidity management tool shall be developed.

[1] I.e., both UCITS and AIFs.

2. Notification obligation

Secondly, the European Commission's Proposal entails that fund managers must notify EU supervisory authorities of the activation and deactivation of liquidity management tools. In addition, disclosure obligations to investors on the conditions for the use of the liquidity management tools are introduced.

LENDING FUNDS

As mentioned above, liquidity management is at the heart of the Amending Directive, which, as something new, contains several liquidity requirements for AIFs issuing loans (lending AIFs). Read about the most significant changes below.

1. Policies and procedures

First, the European Commission proposes a requirement for managers of lending AIFs to establish effective policies and procedures for the issuing AIF, including regarding the assignment of credit, the credit risk assessment, and the management and monitoring of the fund's credit portfolio. The obligation also entails those policies and procedures must be reviewed annually.

2. Loan limitation

Secondly, the European Commission proposes a loan limitation aimed at limiting the AIF's exposure rate and ensuring risk diversification. The loan limitation implies that managers of lending AIFs must ensure that no loans are issued to the same obligor for more than 20% of the AIF's capital if the borrower is a financial undertaking, an AIF or a UCITS. Note that the loan limitation does not apply to borrowers other than those mentioned.

3. Closed structure requirement for significant loan issues

Third, the European Commission proposes a requirement that AIFs that issue loans for more than 60% of their intrinsic value[1] must have a closed structure.

[1] Net asset value.

THE DEPOSITARY SCHEME

Another important purpose of the European Commission's Amending Directive is to streamline the current depositary scheme. Among other things, the European Commission states that the current requirement that depositaries must be located in the same Member State as the appointing EU fund manager is difficult to meet in practice.

1. Temporary cross-border access for depositaries

The European Commission states that there is room for efficiency gains in the market for depositary services. This is especially true in smaller markets where there are fewer depositary service providers, leading to less competition, increased costs and, eventually, less efficient fund structures.

As a temporary measure, the European Commission proposes that EU regulators be equipped with the power to authorise the purchase of depositary services in the other Member States where necessary. This is also expected to lead to savings for both depositaries and users of depositary services, including smaller AIFMs. The measure is expected to apply until further studies have been carried out on the possibility of introducing an EU depositary passport.

2. Central securities depositories shall be involved in the custody chain

The European Commission mentions a particular issue that implies that depositaries in certain cases have had limited or even no access to an AIF's assets when the assets are held in central securities depositories. To address this issue, the European Commission proposes to introduce a requirement that CSDs be considered to be one of the depositary's delegates when it holds an AIF's assets. Rather, this means that CSDs legally become part of the custody chain[1] and are responsible for doing so on an equal footing with depositaries.

[1] The custody chain.

MARKETING AUTHORISATION UNDER THE THIRD COUNTRY REGIME

Foreign AIFs may be marketed to professional investors in the EU in accordance with Articles 36 and 42 of the AIFM Directive if the detailed conditions for doing so are met. The EU Commission's Amending Directive entails minor adjustments in connection with marketing authorisations granted to foreign AIFs under this third-country regime.

Under the third-country regime mentioned above, to market foreign AIFs, the foreign AIF is not established in one of the countries that are on the FATF's (Financial Action Task Force) list of non-cooperative countries. The European Commission proposes to amend the AIFM Directive to refer instead to the EU's lists of non-cooperating countries.

Rather, this means introducing a requirement that the foreign AIF must be established in a country:

- There is no 'high-risk country' under the AMD as amended

- There is no revised list of non-cooperating countries from a tax perspective by the Council of the EU.

The above changes are expected to have an impact in practice, as countries such as the Cayman Islands have been on the latter list in the past. Thus, AIFs established in the Cayman Islands will not be able to meet the conditions for obtaining marketing authorisation under the third country regime if the Cayman Islands are re-listed.

MORE DISCLOSURE OBLIGATIONS

The European Commission states that the market data submitted to regulators is flawed or not sufficiently detailed, making it difficult for authorities to detect the accumulation of risks. Therefore, another essential objective of the Amending Directive is to improve the relevant data collection.

1. New data collection system

The European Commission proposes to develop a new data collection system to provide accurate, comparable, and timely data to the national and European supervisory authorities. This is expected to lower reporting costs and improve market surveillance. To that end, ESMA shall be empowered to develop level 2 standards specifying the details to be reported.

2. Disclosure requirements for investors

In line with the requirements of MiFID, the European Commission's Amending Directive introduces a requirement that managers of AIFs, on a quarterly basis, disclose to investors all fees, costs, and expenses that have been directly or indirectly charged to the AIFM in connection with the operation of its AIFs.

Our banking and finance team will follow the Proposal closely and keep you updated via our usual news updates. If you want to know more, please feel free to contact us.