Fintech boom in Lithuania: new type of financial institution

A new concept of a specialized bank has been incorporated into Lithuania’s legal framework of banking legislation from 1 January 2017.

With some exceptions, specialized banks will not be able to provide investment services, manage investment, pension funds or be active by providing other services related to securities emissions.

However , on other operational levels specialized banks will not differ from full service banks.

Specialized banks have significant competitive advantages and opens the European financial market at lower incorporation and operational costs.

This new type of financial institution is a creation of a regulatory environment and favorable ecosystem for foreign FinTech companies, established to attract foreign financial institutions and FinTech start-ups to Lithuania.

Authorities at both national and municipal levels have shown strong levels of commitment to the previously mentioned goals and Lithuania has an ambitious goal; to become the FinTech leader in the Baltic and Nordic regions.

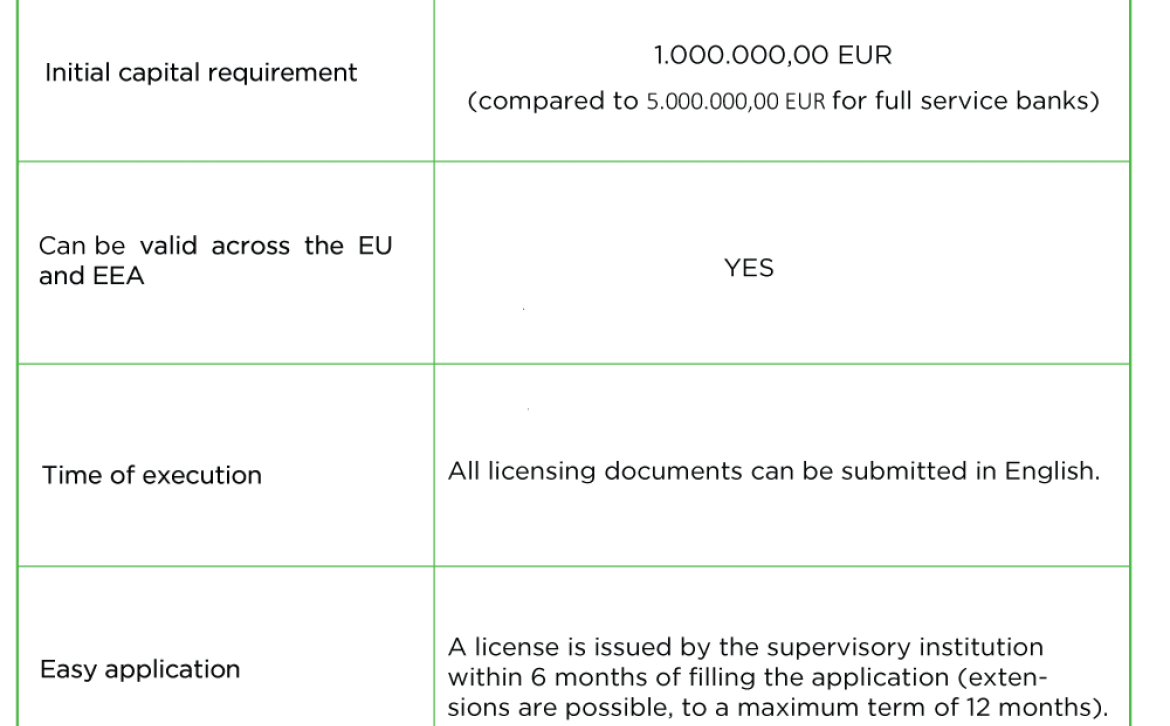

Key advantages of specialized bank concept:

Contact Partner Saulius Aviza (saulius.aviza@njordlaw.lt) or Assistant attorney Gerda Nama-june (gerda.namajune@njordlaw.lt) if you are interested in obtaining a specialized bank license or need any other related help.

Read more about this new type of financial institution here .