Beneficial owners must now be registered

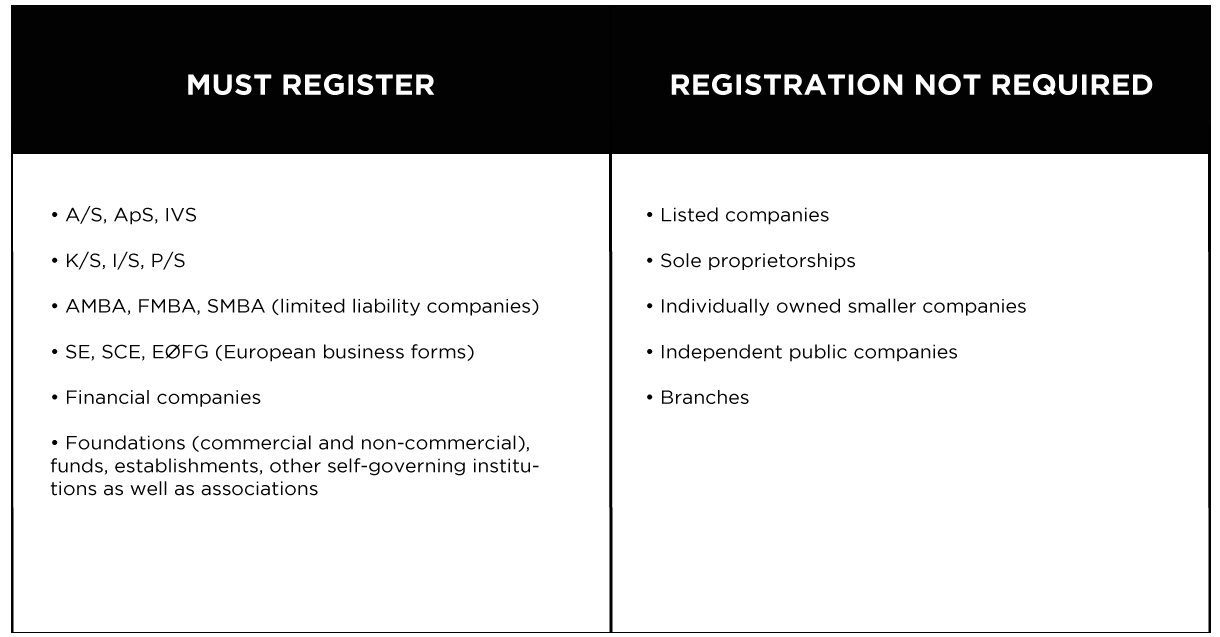

Many companies now have to register their beneficial owners in the Danish CVR registry. As opposed to legal owners, beneficial owners can only be natural persons. Check here if your company is subject to registration.

As the new rules enter into force, a large number of companies must register the natural person(s) who ultimately own or control the registered companies in the CVR register of the Danish Business Authority before December 1, 2017.

Assessing who the beneficial owners of a company are can be difficult. The threshold for when a natural person is considered a beneficial owner is approximately 25% ownership or control. However, this is only a presumption. Therefore, it is necessary to include other factors than the size of the share capital or the number of voting rights.

It is the company's duty to ensure the correct registration and also to obtain and document the information required to assess both ownership and control.

If your company is subject to registration, we can help you identify who must be registered as beneficial owners by reviewing statutes, ownership agreements, pledge agreements and other relevant matters included in this assessment, which can at times be difficult.

The new rules implement the EU's Fourth Anti-Money Laundering Directive with the aim of making corporate structures more transparent and to prevent money laundering and financing of terrorism.

Who is subject to the obligation to register?

Who are beneficial owners?

The registration of companies' beneficial owners differs from the registration of legal owners, which has been mandatory in the last two years. Legal owners can be both companies and individuals, whereas beneficial owners can only be normal persons.

Beneficial owners can be both Danish and foreign natural persons. Beneficial ownership exists when a person owns or controls more than 25% of the ownership interests in the company, directly or indirectly - possibly through one or more subsidiaries, or otherwise exercises control of the company.

The 25% threshold is, however, a presumption of being a beneficial owner and thus not the only factor to consider.

Therefore, when assessing beneficial owners, it is necessary to include factors other than the size of the capital employed or the number of voting rights. A person can thus be a beneficial owner by having votes or capital directly or indirectly in a company, or by controlling another company in another way. It can also be a consequence of a combination of these circumstances.

It is the total actual influence that a natural person has through ownership, voting rights or other forms of control that determines whether the person concerned can be considered a beneficial owner. There is no requirement for controlling influence, and real ownership can also occur with ownership of less than 25% of the ownership interests in the company, etc.

If for example, a person has voting rights transferred through pledge agreements, these rights must also be included. Even potential voting rights, including subscription rights and purchase options that can be utilized or converted, must be included in the assessment for both the issuer and the rightsholder.

The above means, among other things, that there may be an obligation to register more beneficial owners for the same equity.

In practice, the ability of certain capital holders to appoint management members or exercise a veto can pose challenges in the assessment of a company's beneficial owners. . You can read more in the Danish Business Authority's published publication (in Danish).

What must be registered?

The beneficial owner's name, nationality, place of residence, and country of residence must be registered in the Central Business Register (CVR), including the CPR number (Danish Civil registration number).

Then, the nature and extent of the beneficial owner's rights must be stated/described, for example, that the person concerned has:

- the right to appoint members of management,

- veto power,

- the right to approve payments of dividend or

- other rights that may be considered as controlling the company.

Finally, the date of entry of the person's beneficial ownership must be stated. If it is not possible to determine the date, the date of registration must be used.

If there are no beneficial owners, or no beneficial owners can be identified, the registered members of the company's executive board will be registered as the beneficial owners in the CVR registry. Companies must then store documentation of the attempt to identify the beneficial owner(s) for at least five years after the attempt.

It is the company's management who is responsible for registering information about beneficial owners, and the company is also required to check at least once a year whether the information is correct.